Position your business for success with Guardmile.

Join thousands of businesses who:

Already use Guardmile to grow and scale their business, get access to POS terminals, business accounts, business tools and access to top tier loans to grow your business.

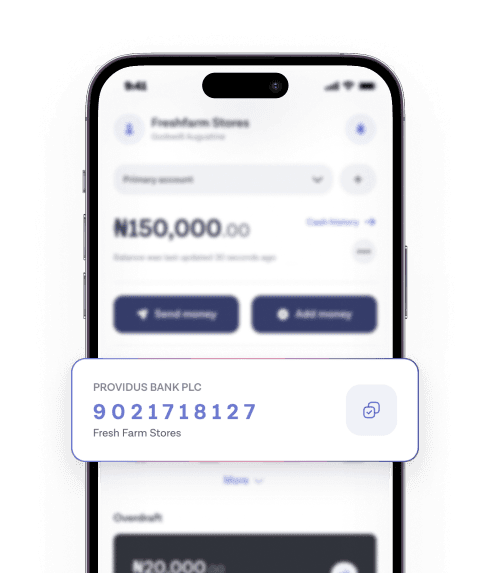

Business account that works.

Say goodbye to personal accounts, Get a business account with Guardmile and start receiving payments, no paperworks, no unnecessary fees.

Receive payment with Guardmile POS.

Quickly accept visa and Mastercard payment from your customers, with a specially designed device for your business.

Manage multiple outlets in one go.

Run a franchise or branch business? No problem, create sub-account for different branches of your business, and get access to everything going on with your business.

A simplified suite of tools to run a smarter business.

Bookkeeping

Track, record sales and expenses from your mobile device with our simplified bookkeeping tool. Say goodbye to pen and paper forever.

Invoicing

Generate and send invoices to your customers, right from your phone. Collect 10X faster with Guardmile digital invoicing.

Inventory Management

Manage your inventories, track your stocks and get live updates on how your business is performing.

Get a 10X credit of your business capital

when you transact with Guardmile.

Get the low rate you deserve.

With Guardmile, low rates are guaranteed on loans for your business, create account to get access.

Build your credit score in realtime

View your business credit score and see how your score grows in real time as you perform transactions.

Flexible Payment Schedules

Paying back is easier with our flexible payment schedule, set your own time and let us handle the rest.

Up to N20,000,000 in Capital

Get access to top tier loans to grow your business comes with a fair rate, flexible payment schedules.

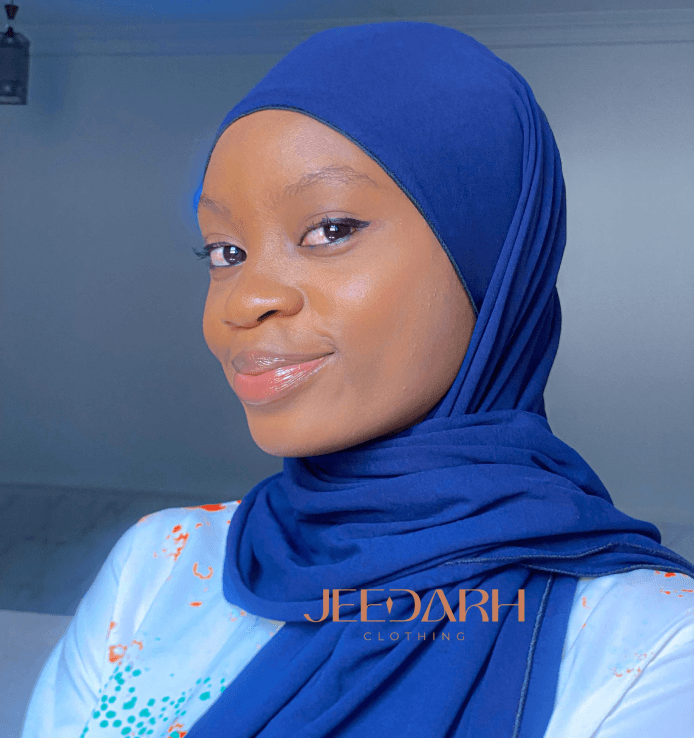

It’s not a theory, it’s a fact. Hear what Guardmile customers have to say.

Before I use to mix my business money with my personal account, making it tough to track my business money. But since I started using this app, I now separate my business money from my personal money and never worry about where my business money is going.

Chidinma Marvelous Okpara

Marvelrich

Faq

What do I need to know about getting my business account?

Your business account will be in your business name like: John Electronics limited. You don't require any documents like CAC documents to get the business account. You get the account in less than 1 mins and start receiving money instantly.

Is there a limit to how much I can receive into the account?

No, there is no limit to the amount you can receive or withdraw from the account

Can anyone with any bank send money to me in this account?

Yes, you can receive money from all banks in Nigeria. You can also send money to any bank in Nigeria.

Is your customer service responsive?

Yes, we even give you a personal account manager once you sign up.

Are there charges on the account?

No, we don't charge you to deposit money or send (withdraw) money to any account.

Start scaling with Guardmile.

Join over 1,000+ business owners who already streamline their

daily business operations with Guardmile software.

- Retail

- Fashion

- Beauty

- Restaurant

Business Type

- Pricing

- Blog

- Communities

Resources

Nigeria